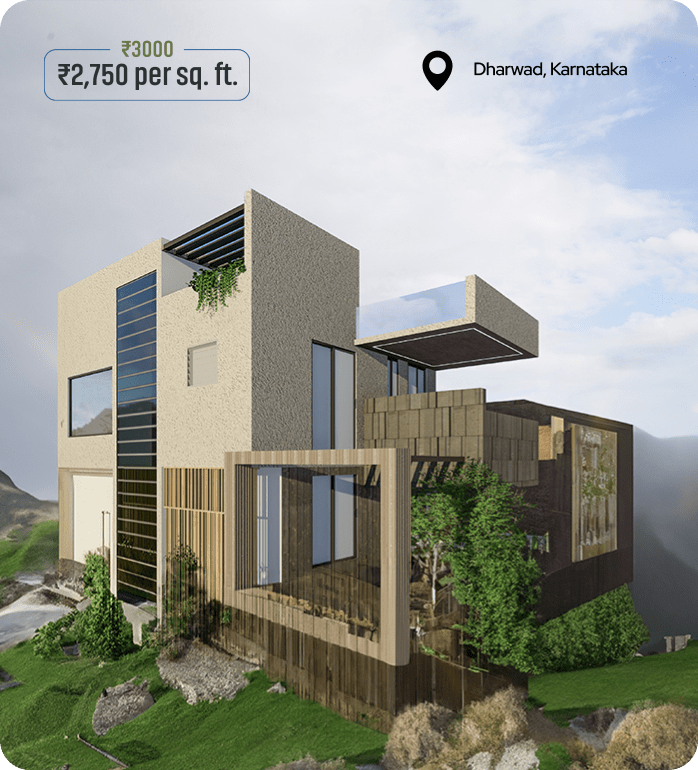

3 & 4 BHK Duplex Villa & Residential Plots Starts at

A Never Before Experience

A Never Before Experience

Convenient Location

Convenient Location

Integrated Township

Integrated Township

Exclusive Amenities

Exclusive Amenities

Buying property in Karnataka — whether in Bangalore, Mysore, or a plot for sale in Dharwad — involves more than just the sale price. One of the crucial aspects every homebuyer should understand is Property Registration Charges in Karnataka. These charges form a significant part of the total property cost and vary based on the property’s value, type, and location.

This comprehensive guide breaks down everything you need to know — from stamp duty rates and registration fees to exemptions, examples, and expert tips to save money.

When you purchase a property, ownership must be legally transferred from the seller to you. This process is formalized through property registration, which involves paying stamp duty and registration fees to the state government.

These are mandatory under the Registration Act, 1908, ensuring that your ownership is legally valid and recognized by law.

The total cost includes two major components:

1. Stamp Duty

It is a tax imposed by the Karnataka government on the property transaction value.

It validates the ownership transfer between the buyer and the seller.

Typically, the stamp duty rate ranges between 5% and 7% of the property’s market value.

2. Registration Fee

A flat fee charged for recording the sale deed in government records.

Usually fixed at 2% of the property’s market value.

Example:

If you buy a property worth 50 lakhs in Karnataka:

Stamp Duty (5%) = ₹2,50,000

Registration Fee (2%) = ₹50,000

Approximately around (7%) of the property value

Total = ₹3,00,000

The Karnataka government has revised rates to promote housing affordability, especially for first-time homebuyers.

| Property Value | Stamp Duty Rate | Registration Fee |

|---|---|---|

| Up to ₹20 lakh | 2% | 1% |

| ₹20–₹45 lakh | 3% | 1% |

| Above ₹45 lakh | 5% | 1% |

Note: These rates apply to both urban and rural areas, though surcharges like cess and local body tax may slightly vary.

Apart from the standard stamp duty and registration fee, buyers should account for:

These smaller charges can collectively add up to a few thousand rupees during registration.

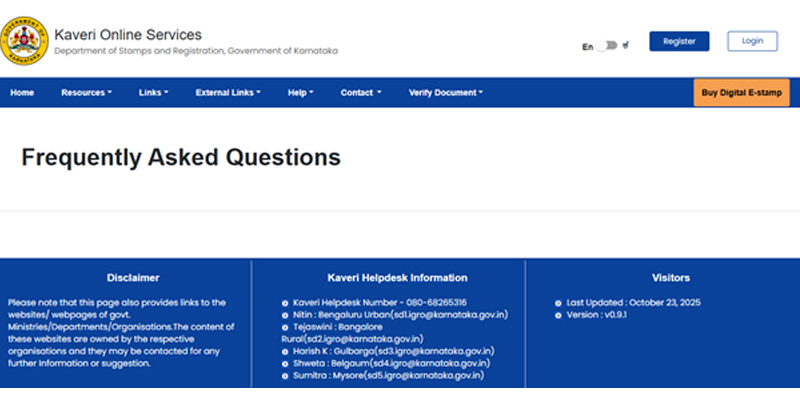

Karnataka offers a digital portal — Kaveri 2.0 portal — that allows users to calculate, pay, and track registration charges seamlessly.

Steps:

While the charges are government-mandated, you can make informed decisions to optimize costs:

The registration process involves both online and in-person steps.

Step-by-Step Process:

Documents Required:

Different property types attract slightly varied costs:

| Property Type | Stamp Duty | Registration Fee |

|---|---|---|

| Apartment (Urban) | 5% | 1% |

| Independent House | 5% | 1% |

| Plot for Sale in Dharwad | 5% | 2% |

| Agricultural Land | 3% | 1% |

For plots, registration is often done based on government guidance value, not the seller’s quote. Always verify the guidance value on the Kaveri portal before registration.

Failure to register your property deed within four months from execution may lead to:

Timely registration protects your investment and ensures clear legal ownership.

Understanding Property Registration Charges in Karnataka is crucial for every homebuyer. It ensures you plan your budget accurately and avoid surprises during purchase. Whether it’s an apartment in Bengaluru or a plot for sale in Dharwad, registration is your official seal of ownership — the foundation of secure property investment.