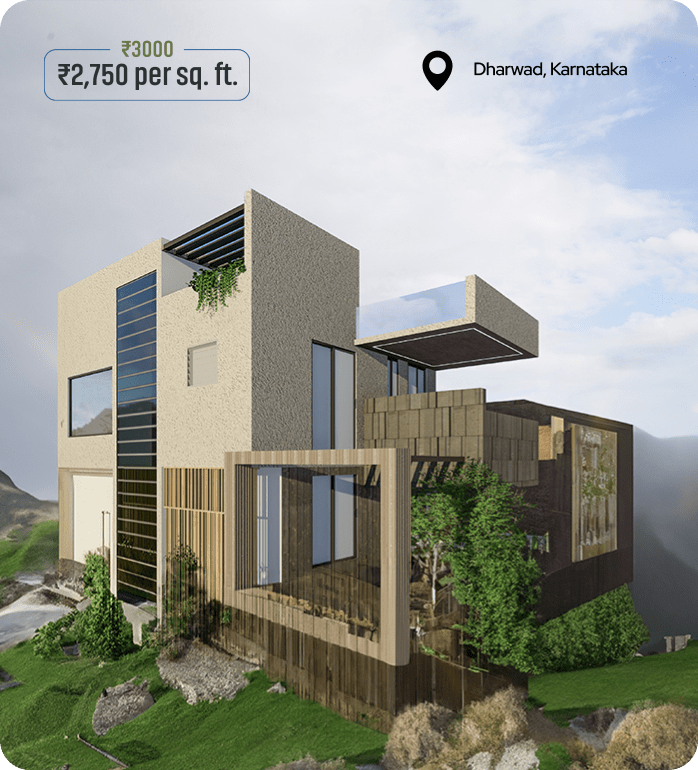

3 & 4 BHK Duplex Villa & Residential Plots Starts at

A Never Before Experience

A Never Before Experience

Convenient Location

Convenient Location

Integrated Township

Integrated Township

Exclusive Amenities

Exclusive Amenities

Property ownership in Dharwad comes with the responsibility of paying annual property taxes to the Hubballi-Dharwad Municipal Corporation (HDMC). Whether you're a homeowner, apartment dweller, commercial property owner, or someone with a plot for sale in Dharwad, understanding property tax Dharwad regulations is crucial for maintaining legal compliance and protecting your investment.

Property tax Dharwad is a mandatory annual levy imposed by HDMC on all immovable properties within its jurisdiction. This includes residential homes, apartments, commercial buildings, industrial facilities, and vacant land parcels. The tax revenue collected plays a vital role in funding essential civic services such as road maintenance, waste management, street lighting, sanitation systems, and other public infrastructure projects that directly benefit residents.

When you pay property tax Dharwad, you're not just fulfilling a legal obligation – you're actively contributing to the city's development and ensuring better living standards for all residents.

The importance of property tax Dharwad extends beyond legal compliance:

Failure to pay property taxes can result in penalties, legal notices, and potential complications during property transactions. Regular payment protects you from these issues.

Property tax receipts serve as crucial proof of ownership when applying for bank loans, selling property, or dealing with government agencies. These documents verify your legal right to the property.

Your tax contributions directly fund improvements to roads, parks, drainage systems, and other facilities that enhance property values and quality of life in Dharwad.

Maintaining updated tax records increases your property's market value and attracts serious buyers, particularly important if you have a plot.

HDMC employs the Unit Area Value (UAV) system for calculating property tax Dharwad. This comprehensive method considers multiple factors to determine your tax liability:

Property Tax = (Built-up Area × Unit Area Value × Usage Factor × Occupancy Factor) + Educational Cess - Applicable Rebates

Consider a 1,200 square feet residential property located in Zone B with a unit area value of ₹2 per square foot. The base calculation would be 1,200 × ₹2 = ₹2,400. Adding the standard 15% educational cess (₹360) brings the total to ₹2,760. If you qualify for a 5% early payment rebate, your final property tax Dharwad would be ₹2,622.

HDMC offers several incentives to encourage timely property tax Dharwad payments:

Property owners who pay their annual tax within the first quarter (typically by June 30) receive a 5% discount on the total amount due.

Elderly property owners may qualify for additional discounts based on age and income criteria.

Properties with solar panels, rainwater harvesting systems, or other environmentally sustainable features may receive special rebates.

Late payments attract a 2% monthly compound interest charge, making prompt payment financially advantageous.

The digital payment system has revolutionized how residents handle property tax Dharwad transactions:

Traditional payment methods remain available for those preferring in-person transactions:

Even vacant plots require annual property tax Dharwad payments, though typically at lower rates than developed properties. This tax obligation ensures:

Maintaining current tax records is particularly crucial if you have a plot, as prospective buyers often require tax clearance certificates before completing transactions.

Submit supporting documents to the HDMC office for corrections to ensure accurate property tax Dharwad calculations.

Retrieve your PID online using previous receipts or property addresses through the HDMC portal.

Keep transaction IDs for reference and contact customer support or visit offices if online payments fail.

Pay outstanding amounts with applicable penalties and interest to avoid legal complications.

Recent developments in property tax Dharwad administration include:

HDMC's e-Aasthi initiative has digitally registered over 100,000 properties, streamlining the entire tax process.

For FY 2024-25, HDMC set an ambitious revenue target of ₹141 crores, with over ₹100 crores already collected by mid-year.

Property tax rates typically increase by approximately 3% annually to account for inflation and infrastructure development costs.

Rural Dharwad areas show pending dues of ₹74.6 crores across approximately 140,000 properties, highlighting the importance of timely payments.

HDMC continues modernizing its property tax Dharwad systems with planned improvements, including:

Understanding and managing property tax Dharwad obligations is essential for all property owners in the region. Whether you choose online convenience or offline reliability, prompt payment protects your investment, supports community development, and ensures legal compliance. For current homeowners, maintaining updated tax records provides peace of mind and financial benefits. For investors with land holdings, including those with a plot, current tax payments significantly enhance property marketability and value.

By staying informed about property tax Dharwad regulations and maintaining consistent payment schedules, you contribute to Dharwad's growth while protecting your property investment for the future.